...return of 3x the money again.

The fund's investment policy

The Danish fund will invest 75% of its funds directly in Rebel Fund III, and the remaining 25% in Co-investments. Co-investments will be in investments in companies that are already in Rebel Fund I and II, but where the funds for later rounds of investment are not available. By investing up to 25% in companies that are more advanced in terms of maturity and performance, an overall risk reduction is theoretically achieved without a corresponding reduction in upside. Another advantage is that costs are reduced overall as up to 25% of the investments are made in companies directly, and not in one or more funds with resulting fee structures.

Our partners

Rebel partners are among the most prominent YCombinator alumni, having founded multi-billion dollar technology companies that today are collectively valued at over $100 billion USD. While continuing to run their companies full-time, Rebel partners assist the fund with due diligence and selection of portfolio companies in their areas of expertise. As a small proportion of startups account for the vast majority of venture returns, Rebel leverages these leading "YC-Unicorns" founders to identify and support the companies with the greatest potential.

Theorem

Rebel Theorem is a proprietary machine learning algorithm that sorts through hundreds of YC startups to select the best ~25 % for further due diligence. The algorithm weights several factors related to the founder team and other characteristics. It was developed specifically for Rebel in collaboration with data science experts trained at MIT and Carnegie Mellon University and is based on published academic research. Backtesting shows that the YC startups that score highest on the Rebel Theorem perform significantly better than their peers.

Performance benchmark

YCombinator startups have achieved a 3-5 times higher rate of unicorns compared to other venture-backed companies, and Rebel Fund portfolio companies have outperformed even the YC average. According to AngelList's fund benchmarks, Rebel's returns are solidly in the top quartile of all early-stage venture funds. Rebel's portfolio companies are now collectively valued at over 12 billion USD and include several unicorns. YCombinator is the world's leading incubator for tech startups with over 100 portfolio companies, each now valued at over $1 billion, including Airbnb, Coinbase, DoorDash and Stripe. The combined enterprise value of all YC startups exceeds 600 billion USD. YC has an intake rate of less than 1 % and the Rebel Fund is designed to invest in the top 10 % of YC startups in each batch - equivalent to the top 0.1 % of all YC applicants.

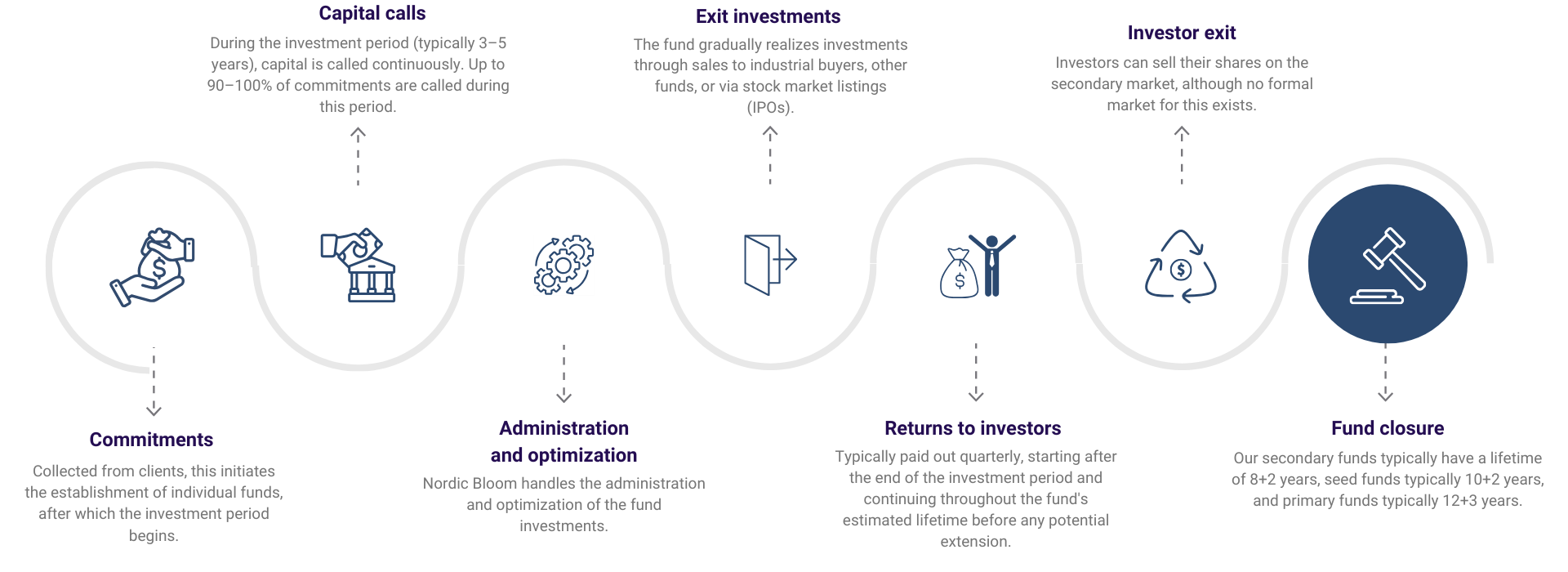

As an authorised alternative investment manager, Nordic Bloom offers parallel funds with no extra layer of costs for the same investment amount, in exclusive collaboration with US Rebel Fund, participation in US Seed Fund III A/S.